LegalHelp123

New Member

- Jurisdiction

- Ohio

I'm from texas. Loaned a man and his wife money in Ohio with documented and signed payment terms. Man and the wife tried to disappear. Won a summary judgement and now have a lien on their house.

They defaulted on another loan from a bank in Ohio and are currently having wages garnished. Couple of quesitons:

1) as I start proceedings on garnishing their wages, do i have to physically appear in court in Ohio when representing myself?

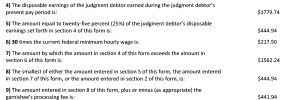

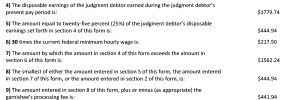

2) Assuming the garnishment is approved, how does that work with the payment currently being garnished? They owe about $12,000 more to that other lawsuit. Would i have to wait until that finishes or would they be able to start garnishing for me at the same time if their paycheck meets the limits (typically using this as a formula - Under federal law (the Consumer Credit Protection Act), a maximum of 25% of a debtor's disposable income can be garnished, or the amount by which their disposable earnings exceed 30 times the federal minimum wage, whichever is less.)

Here's their current situation:

They defaulted on another loan from a bank in Ohio and are currently having wages garnished. Couple of quesitons:

1) as I start proceedings on garnishing their wages, do i have to physically appear in court in Ohio when representing myself?

2) Assuming the garnishment is approved, how does that work with the payment currently being garnished? They owe about $12,000 more to that other lawsuit. Would i have to wait until that finishes or would they be able to start garnishing for me at the same time if their paycheck meets the limits (typically using this as a formula - Under federal law (the Consumer Credit Protection Act), a maximum of 25% of a debtor's disposable income can be garnished, or the amount by which their disposable earnings exceed 30 times the federal minimum wage, whichever is less.)

Here's their current situation: